Bidding Opportunities

Thank you for your interest in bidding opportunities with the New Jersey Economic Development Authority.

Please see the links below to visit the page for the type of bidding opportunity you are interested in.

Business Support Administrative Goods and Services Bidding Opportunities

Below please find a list of IPM Administrative Goods and Services bidding opportunities currently being offered by the New Jersey Economic Development Authority. Please see the listing below for the opportunity that is of interest to you:

QUESTIONS ARE DUE BY: May 1, 2023 2:00PM(ET)

PROPOSALS ARE DUE BY: May 22, 2023 2:00PM(ET)

SECOND ROUND OF QUESTIONS ARE DUE BY: September 8, 2023 2:00 PM (ET)

PROPOSALS ARE DUE BY: September 26, 2023 2:00PM(ET)

Questions due by: Wednesday, April 24, 2024 at 1:00pm (EST)

Qualification Submittals due by: Thursday, May 30, 2024 at 1:00pm (EST)

Mandatory Site Visit Dates: Tuesday, May 7, 2024 at 10:00am (EST) or Tuesday, May 14, 2024 at 10:00am (EST)

- 198 – Addendum #1

- 198 – 2023-RFQ-198 REVISED

- 198 – Legal Notice

- 198 – 2023-RFQ-198

- 198 – Exhibit A – Professional Services Qualification Statement (PSQS)

- 198 – Exhibit B – Method of Operation

- 198 – Exhibit C1 – TOR Request

- 198 – Exhibit C2 – TOR COI

- 198 – Exhibit C3 – TOR Response

- 198 – Exhibit D – Proposer’s Checklist

- 198 – Exhibit E – Signatory Page

- 198 – Exhibit F – Site Access Directions

- 198 – Exhibit G – Visitor’s Assumption of Risk

- 198 – Exhibit H – Tour Application

- 198 – Exhibit I – Project Overview

- 198 – Exhibit J – Notice of Required Compliance

- 198 – Exhibit K – Insurance Requirements

- 198 – Exhibit L – Contract for Services

- 198 – Exhibit M – Rider for Purchases Funded by Federal Funds

Second round of questions due by: Friday, March 1, 2024 at 2:00pm (EST)

Responses due by: Monday, April 1, 2024 at 2:00pm (EST)

- 181 – Addendum #3

- 181 – Addendum #2

- 181 – Exhibit D – Supplement to Addendum #2 – Question 1

- 181 – Exhibit E – Rider D Insurance Requirements

- 181 – Exhibit F – Owner’s Requirements

- 181 – Addendum #1

- 181 – 2023-RFP-181

- 181 – Exhibit C – NJEDA Insurance Risk Profile

- 181 – Legal Notice

- 181 – Fee Schedule

- 181 – Proposer’s Checklist

- 181 – Signatory Page

- 181 – Exhibit A – Contract for Services

- 181 – Exhibit B1 – TOR Request

- 181 – Exhibit B2 – TOR COI

- 181 – Exhibit B3 – TOR Response

REal Estate Procurement opportunities

Below please find a list of Real Estate procurement opportunities currently being offered by the New Jersey Economic Development Authority. Please see the listing below for the opportunity that is of interest to you:

Currently there are no open bidding opportunities. Please check back often. New opportunities are posted as they become available. Thank you.

Questions are due: September 26th at 1:00pm

Qualification Submittals are due: October 10th at 1:00pm

- 0000060 – Addendum #1

- 0000060 – Legal Notice

- 0000060 – 2023-RERFQ-0000060

- 0000060 – Exhibit A-1 – Contractor’s Qualification Statement – AIA Document A305

- 0000060 – Exhibit A-2 – RCM 1

- 0000060 – Exhibit B – Acknowledgement of Receipt of Addenda / Q&A form

- 0000060 – Exhibit C – Submittal Checklist

- 0000060 – Exhibit D – Notice of Executive Order 166 Requirement for Posting Winning Proposal and Contract Documents

- 0000060 – Exhibit E – Notice of Required State of New Jersey Compliance (Informational Purposes)

- 0000060 – Exhibit F – Notice of Required Terms Relating To All Contracts Funded, In Whole or In Part, By Federal Funds (Informational Purposes)

- 0000060 – Exhibit G – Insurance Requirements (Informational Purposes)

- 0000060 – Exhibit H – Terms and Conditions Relating to Contracting With Minority, Women and Veteran Owned Businesses

Questions are due: September 11th at 2:00pm

Qualification Submittals are due: September 29, 2023 at 2:00pm

- 0000059 – Addendum #2

- 0000059 – 2023-RERFQ 0000059-REVISED

- 0000059 – Addendum #1: September 15, 2023

- 0000059 – Legal Notice

- 0000059 – 2023-RERFQ-0000059

- 0000059 – Exhibit A – Professional Services Qualification Statement (PSQS)

- 0000059 – Exhibit B – RFQ Firm Project Matrix

- 0000059 – Exhibit D – Acknowledgement of Receipt of Addenda / Q&A form

- 0000059 – Exhibit E – Submittal Checklist

- 0000059 – Exhibit F – Notice of Required State Compliance

QUESTIONS MUST BE SUBMITTED VIA E-MAIL BY: FEBRUARY 12,2024, 11:59 PM U.S.(ET)

OFFER DEADLINE POSTPONED UNTIL: 3:00 PM U.S (ET), MAY 3, 2024

- Addendum #5

- Addendum #4

- Addendum #3

- Addendum #2

- Addendum #1

- NJWP Notice to Lease

- Exhibit A – Lease Notice Offer Instruction and Letter Template

- Exhibit B – Key Lease Terms

- Exhibit C – Compliance Checklist

- Exhibit D – Ownership Disclosure Form

- Exhibit E – Ground Lease Between PSEG Nuclear LLC, as Landlord, and NJEDA, as Tenant

- Exhibit F – Compliance Requirements Pertaining to the New Jersey Wind Port

- Exhibit G – Confidentiality Agreement

- Exhibit H – Iran Disclosure Form

- Exhibit I – NJWP Tour Slide Deck

Industry Engagement – Requests for Information (RFI)

Below please find a list of RFIs currently being offered by the New Jersey Economic Development Authority. Please see the listing below for the RFI that is of interest to you:

New Jersey Economic Development Authority

REQUEST FOR INFORMATION

2023-RFI-180 for Commercial Building Decarbonization

NJEDA is extending the deadline to submit responses to the Commercial Building Decarbonization RFI to 5:00 pm EDT on July 24, 2023.

INTENT/SUMMARY OF SCOPE

The New Jersey Economic Development Authority (“Authority,” “NJEDA,” or “EDA”), an independent authority of the State of New Jersey, is seeking information and ideas from qualified entities (“Respondents”) regarding potential programs and funding allocations from the EDA to support commercial building decarbonization projects in the State. Specifically, the EDA would be focusing on potential programs for commercial buildings, but these may also include institutional, industrial, and larger multifamily buildings.

Building decarbonization refers to efforts to reduce greenhouse gas emissions from the building sector. This includes, but is not limited to, reducing operational emissions via fuel switching; beneficial electrification; energy efficiency improvements; on-site renewable energy generation and storage; replacement, repairs, or installation of leak detection systems for highly warming refrigerants; and implementation of demand responsive building systems. In addition, embodied carbon can be considered, which includes also evaluating the lifecycle emission impacts of the materials that make up the physical construction of the building. Reducing embodied carbon for a building includes evaluating and reducing emissions resulting from a building material’s extraction, manufacturing, transport, construction, maintenance, and disposal.

The Authority is interested in receiving information (including but not limited to comments, questions, recommendations, white papers, tools, case studies, information, ideas, references, and general responses, e.g., willingness to participate in a focus group) that will help it to shape new programs and initiatives to accelerate building decarbonization within the commercial building sector within New Jersey. More specifically, this RFI aims to help the Authority better understand:

- The key opportunities and barriers (financial, policy, regulatory, technological, logistical) around decarbonization of commercial buildings in New Jersey.

- Specific partnerships, funding, programs, and/or other resources needed to enable building decarbonization projects to occur.

BACKGROUND

The Authority serves as the State’s principal agency for driving economic growth. The Authority is committed to making New Jersey a national model for inclusive and sustainable economic development by focusing on strategies that help build strong and dynamic communities, create good jobs for New Jersey residents, and provide pathways to a stronger and fairer economy. Through partnerships with a diverse range of stakeholders, the Authority creates and implements initiatives to enhance the economic vitality and quality of life in the State and strengthen New Jersey’s long-term economic competitiveness.

Under the leadership of Governor Murphy, New Jersey has taken bold action to reduce climate pollutants and accelerate the transition to clean energy, while fostering growth of our clean energy economy. The State has set several key energy and climate targets, including transitioning to 100% clean electricity by 2035 (Murphy E.O. 315). The “Global Warming Response Act”, P.L. 2007, c.112, (“GWRA”) commits New Jersey to reducing its greenhouse gas emissions by 80% below 2006 levels by 2050, and as updated within Murphy E.O. 274, to 50% below 2006 levels by 2030.

Governor Murphy has furthered the push for building decarbonization in the State with the goal that, by December 31, 2030, 400,000 additional dwelling units and 20,000 additional commercial spaces and/or public facilities statewide will utilize electric systems for space heating/cooling and water heating (Murphy E.O. 316).

Buildings currently are the second highest source of overall greenhouse gas emissions (26% of total emissions) in the State. Commercial buildings alone account for 10% of the total greenhouse gas emissions in the State (NJDEP Greenhouse Gas Inventory, Dec. 2022). Most building-generated direct greenhouse gas emissions result from space heating via energy derived from fossil fuel combustion. A smaller portion is derived from similar energy used for water heating and cooking. Greenhouse gas emissions from electric consumption within buildings are already accounted for via overall electric generation sources (21% of the State’s total emissions).

Therefore, reducing greenhouse gas emissions from the building sector is a critical strategy for reducing overall statewide emissions. This work includes retrofitting and upgrading existing buildings in the State while also constructing new buildings to highly efficient and net zero carbon/energy standards. As outlined in the State’s 2019 Energy Master Plan, successfully acting to combat the threat of climate change includes expanding the clean energy innovation economy to “support the growth of in-state clean energy industries through workforce training, clean energy finance solutions, and investing in innovative research and development programs.”

In accordance with a statewide effort to address environmental justice (Murphy E.O. 23), the Authority is committed to prioritizing building decarbonization and clean energy investments in the State’s overburdened communities—those that have been subject to a disproportionally high number of environmental and public health stressors due to a legacy of historically siting sources of pollution in low-income communities and communities of color.

ELIGIBILITY CRITERIA

The RFI is seeking responses from all interested stakeholders. Specifically, this RFI welcomes input from entities, organizations, and individuals including:

- Commercial building owners and property developers of all development models and sizes, including those with single buildings or larger portfolios

- Financial institutions involved in real estate transactions and construction financing

- Building management, maintenance, and operations personnel

- Building construction businesses and workers, including but not limited to industry associations, chambers of commerce, and unions

- Other businesses and associated trade groups (restaurants, manufacturers, retailers, grocers, etc.)

- Building design professionals (engineers, architects, planners, modelers, etc.), especially those with experience in green buildings, energy management, and building decarbonization approaches

- Subject matter experts and entities with expertise on green building technologies and best practices, including research institutions

- Manufacturers and installers for electric heating and cooling systems (including heat pumps, VRF systems) and other electric appliances

- Energy efficiency, building envelope, and related contractors

- Utility providers and operators

- Environmental and other public policy-focused organizations

- Organizations representing Environmental Justice communities (together with individual representatives of these communities)

- Jurisdictional and regulatory representatives (from NJ, all other states and territories, and international sources)

Qualified entities do not need to be located within the State of New Jersey to provide a response.

RFI RESPONSE QUESTIONS

In submitting responses to this RFI, respondents are encouraged to answer any questions they consider relevant and to the best of their ability. Respondents do not need to answer all questions for their response to be considered. Answers are understood to be preliminary and non-binding. Respondents are free to go beyond the scope of the questions and/or structure responses as necessary to increase clarity and efficiency of responses. Respondents should also feel free to submit additional or alternate information as deemed necessary and appropriate.

The NJEDA is considering establishing programs to support building decarbonization projects in New Jersey for the commercial, industrial, and institutional sectors. Potential programs are intended to provide financial support for building decarbonization projects for retrofits and/or new construction. Projects may include, but are not limited to, electrifying building systems/appliances, conducting energy efficiency improvements, and related work that reduces greenhouse gas emissions from the State’s buildings sector. Financial support may be in the form of low interest/forgivable loans, grants, and/or other financing mechanisms. In particular, the NJEDA is looking to understand what kind of additional financial support it can provide to complement other existing building incentive and financing programs offered from its public and private partners.

The questions within this RFI are intended to garner feedback on potential programs and priorities, as well as solicit general information from relevant stakeholders.

Background

- Please provide information on you/your entity’s background (name, location, organization/business type and size), and your involvement or interest in building decarbonization. How do you define building decarbonization?

Building Decarbonization Projects

2. Given New Jersey’s clean energy goals and commitment to building decarbonization, what specific actions would you recommend the NJEDA take to accelerate building decarbonization in the State?

3. What are the major financial barriers (e.g., construction/installation costs, operational costs, access to capital, enabling work required, investment payback period, etc.) and non-financial barriers (e.g., regulatory barriers, lack of familiarity with new building system technologies, operational and reliability issues, procurement timelines, space constraints, etc.) to the pursuance of building decarbonization projects in New Jersey?

a. How can these barriers be addressed and overcome?

4. Where are there gaps in existing incentive programs (considering all incentives at the local, utility, state, and federal level) that are meant to encourage adoption of energy efficiency improvements, implementation of on-site renewable energy generation, and similar projects related to building decarbonization goals?

a. Are there project costs not adequately covered by incentives that prohibit participation in building decarbonization?

b. Is the timeline for awarding incentives within the overall project schedule sufficient to encourage participation?

5. For what kind of projects [size (capital cost or square footage), building type (style or material), occupant use] is additional financial support for building decarbonization most needed?

a. During what phase (design, procurement, construction, commissioning, etc.) of a typical construction project (renovation or new construction) would this support be most valuable?

6. Does the recognition from securing industry-recognized building certifications (i.e., LEED, ILFI, Passive House, etc.) provide any/sufficient incentive for pursuing building decarbonization projects?

a. Are these certifications appropriate metrics to use for properly evaluating a building’s emissions/energy performance, or should other approaches be used?

b. Are there barriers (i.e., administrative time, application fees) to securing these building certifications that impact decisions on whether to pursue net-zero energy/carbon building design on a given project?

7. Are there any specific or notable barriers to building decarbonization projects that are unique to overburdened communities?

a. How can these barriers be overcome or eliminated?

b. In what ways can residents of overburdened and environmental justice communities be supported to engage in building decarbonization projects both in their own communities and beyond?

c. How could a program best support the inclusion of small and diverse businesses in the building decarbonization economy?

Building Decarbonization Strategies and Technologies

8. Which technologies that support building decarbonization are most viable for adoption in New Jersey in the immediate term? Which technologies are not (or not yet) viable for adoption? Please explain your reasoning and provide any supporting references.

9. Please describe the factors that are considered when deciding when to replace or upgrade building systems and determining what technologies should be utilized if replacement occurs. This includes MEP systems, appliances, and building envelope components.

10. Do building owners and/or business owners have sufficient sources of information to make informed decisions on which technologies or equipment to adopt in their buildings?

a. Are building operations and maintenance personnel adequately trained and comfortable working with new technologies?

b. If not, what possible steps could be taken to help support education and information sharing to support building decarbonization adoption?

11. To what extent does consideration of embodied carbon (i.e., lifecycle emissions impact of building materials and construction/deconstruction methods) factor into project decisions about building design and construction?

a. In what ways could financial support accelerate the consideration of embodied carbon on a project level or larger industry scale?

12. What type or level of additional incentives or financial support would be necessary to encourage adoption of building technologies and construction methods that surpass existing minimum building code requirements for energy performance

QUESTIONS AND ANSWERS (from Respondents to NJEDA)

All questions concerning this RFI must be submitted in writing no later than 5:00 PM ET, on Monday, June 19, 2023, via e-mail to: buildingdecarbRFI@njeda.gov.

The subject line of the e-mail should state: Questions-2023-RFI-180.

Answers to questions submitted will be publicly posted on the Authority’s website on or about Monday, June 26, 2023, at: https://www.njeda.gov/bidding/#OET as Addenda.

IT IS THE RESPONDENT’S RESPONSIBILITY TO CHECK THIS URL REGULARLY FOR UPDATES.

RESPONSE DETAILS (Info Provided to Respondents Regarding Document Submission)

All RFI responses must be submitted in writing no later than 5:00 PM ET on Monday, July 24, 2023, via e-mail to: buildingdecarbRFI@njeda.gov.

The subject line of the e-mail should state: RFI Response-2023-RFI-180.

FOLLOW-UP QUESTIONS (from NJEDA) / ADDITIONAL INFORMATION

Respondents may be invited to provide additional information to allow the Authority to better understand information provided.

PROPRIETARY AND/OR CONFIDENTIAL INFORMATION

The Authority reserves the right to copy any information provided by the Respondents. The Authority reserves the right to use ideas that are provided by Respondents, applicants, stakeholders, or vendors. By submitting a Response, the submitter represents that such copying or use of information will not violate any copyrights, licenses, or other agreements with respect to information submitted or product solutions demonstrated, if applicable. Responses must clearly be marked for any information the Respondent deems Proprietary and/or Confidential.

The Authority further reserves the right to share information with the NJDEP, NJBPU, and the Governor’s Office on Climate Action and the Green Economy

DISCLAIMER / NO OBLIGATION

The Authority is under no obligation to contact Respondents to this RFI. If necessary, it may contact respondents through telephone calls, written or electronic communications, presentation requests and/or interviews to seek clarification on submissions. Please note that, Respondents shall not be under any obligation to respond to any such request.

This RFI is completely voluntary and will not affect scoring or consideration of any applications that may in the future be submitted to the Authority under programs or projects intended to strengthen New Jersey’s clean energy economy.

This RFI is issued solely as a means of gathering information. Interested parties responding to this RFI do so at their own expense. There will be no monetary compensation from the Authority for the time and effort spent in preparing the response to this RFI. All expenses incurred are the sole responsibility of the Respondent.

This RFI is not a request for qualification/proposal. It may or may not result in further action.Should the Authority to move forward and issue an RFQ/P or announce a program/product related to this RFI, Respondents need not have submitted a response to this RFI in order to be eligible for the program or to respond to the RFP. Should an RFQ/P be issued, responding to this RFI will not affect scoring or consideration for that process.

NEW JERSEY OPEN PUBLIC RECORDS ACT

Respondents should be aware that responses to this RFI are subject to the “New Jersey Open Public Records Act” (N.J.S.A. 47:1A-1 et seq.), as amended and including all applicable regulations and policies and applicable case law, including the New Jersey Right-to-Know law. All information submitted in response to the RFI is considered public information, notwithstanding any disclaimers to the contrary, except as may be exempted from public disclosure by OPRA and the common law.

Any proprietary and/or confidential information submitted in response to this RFI will be redacted by the Authority. A person or entity submitting a response to this RFI may designate specific information as not subject to disclosure pursuant to the exceptions to OPRA found at N.J.S.A. 47:1A-1.1, when such person or entity has a good faith legal and/or factual basis for such assertion (i.e. information that may be included in another ongoing public procurement or solicitation). The Authority reserves the right to make the determination as to what is proprietary or confidential and will advise the person or entity accordingly. The Authority will not honor any attempt to designate the entirety of a submission as proprietary, confidential and/or to claim copyright protection for the entire proposal. In the event of any challenge to the Respondent’s assertion of confidentiality with which the Authority does not concur, the Respondent shall be solely responsible for defending its designation.

New Jersey Economic Development Authority

REQUEST FOR INFORMATION

2023-RFI-199 – Development of a Statewide Employee Ownership Program

1. INTENT/SUMMARY OF SCOPE

The New Jersey Economic Development Authority (“Authority”), an independent Authority of the State of New Jersey, is seeking information and ideas from qualified entities (“Respondents”).

This Request for Information (RFI) is issued by the New Jersey Economic Development Authority (“Authority”, “NJEDA”) to seek information from firms and individuals with perspectives on the proven best practices, potential challenges and appropriate considerations relevant to the development of a Statewide Employee Ownership program. The creation of such program would aim to engage interested parties, potential consultants, and eligible businesses in the establishment and success of an employee ownership model with the support of the Authority. The NJEDA is interested in receiving comments, questions, recommendations, facts, information, ideas, and responses that will help the NJEDA better understand the scope and characteristics of Employee Ownership – highlighted as a potential Wealth Disparity Initiative by the Governor’s Wealth Disparity Task Force – in anticipation of the development of a Statewide Employee Ownership Program.

2. BACKGROUND

The New Jersey Economic Development Authority serves as the State’s principal agency for driving economic growth. The Authority is committed to making New Jersey a national model for inclusive and sustainable economic development by focusing on key strategies to help build strong and dynamic communities, create good jobs for New Jersey residents and provide pathways to a stronger and fairer economy. Through partnerships with a diverse range of stakeholders, the Authority creates and implements initiatives to enhance the economic vitality and quality of life in the State and strengthen New Jersey’s long-term economic competitiveness.

The Wealth Disparity Task Force (WDTF), under Executive Order 262, was charged to examine the causes of and remedies for the long-standing racial and ethnic-based wealth disparities in New Jersey. Each of the five working groups were tasked with offering recommendations in the areas of criminal justice, economy, education, health, and housing. During the course of its work, the Wealth Disparity Task Force recommended broadening employee ownership opportunities in New Jersey to support asset limited income constrained workers. (ALICE – United Way).

3. ELIGIBILITY CRITERIA (If applicable)

NJEDA is soliciting input from any of the following groups: New Jersey-based businesses of any size and industry; Employee-Owned entities located within the United States; Employee Stock Ownership Plan (ESOP) technical assistance providers; Chambers of Commerce and other business advocacy organizations; business and entrepreneurship support organizations; Community Development Financial Institutions (CDFIs) and Minority Depository Institutions (MDIs); policy and academic researchers; foundations and philanthropic initiatives that support Employee Ownership and/or work to address socioeconomic disparities; any other individual or entity who has perspectives or experiences relevant to this Request for Information.

4. RFI RESPONSE QUESTIONS

Description of your role and qualifications related to creating, administering, or contributing to a statewide Employee Ownership Programs:

- Please provide information on your organization, group, government entity, or self and your capacity and qualifications as they relate to Employee Ownership.

- What is your experience with and understanding of Employee Stock Ownership Plans (ESOPs) Employee Ownership Trusts (EOTs), and/or Employee Ownership?

- Which key areas are you/your organization most qualified to address (choose and explain how all that apply)?

- Technical assistance relating to the conversion of a company to Employee Ownership

- Business outreach and public education on Employee Ownership

- Financial, technical, legal, and/or other needs of companies interested in converting to an Employee-Owned company

- Statewide Employee Ownership financial product development and administration

Other, please explain

For Business Owners and Business Support Organizations – Experienced and/or potential challenges related to Employee Ownership Programs:

- If your organization or entities with which your organization works have converted to an Employee-Owned entity:

- What are some of the challenges your organization has directly experienced relating to Employee Ownership?

- How successful was this opportunity to your organization?

- What tools led to this success?

- If your organization is not Employee-Owned but has considered converting to Employee Ownership:

- What are some of the challenges your organization has become aware of relating to Employee Ownership?

- Are these challenges preventing you from taking action towards converting to Employee Ownership?

- What types of financial or technical support have been/could be most critical to the conversion of a business to Employee Ownership? Please be as specific as possible.

- Please provide any information relating to Employee Ownership that you feel is relevant for the NJEDA to understand.

- Provide examples or experiences, if you are aware of any, related to industry best practices regarding other states launching and administering a statewide Employee Ownership program

For Employee Ownership Industry Partners, Researchers, Institutions, and Policy Experts – Experienced and/or potential challenges related to Employee Ownership:

- In your experience, what are the ways in which Employee Ownership can support minimizing the wealth divide, especially for historically socioeconomically disadvantaged groups?

- What types of financial or technical support have been/could be most critical to the conversion of a business to Employee Ownership?

- What key considerations should the State be aware and mindful of during the development of an Employee Ownership program?

- What financial mechanisms are most critical to developing a comprehensive public-facing Employee Ownership program?

- What are industry standards and best practices to be considered when building a program to help support Employee Ownership plans?

- What other states or entities have existing programs/models that have been successful in supporting efforts for Employee Ownerships plans? How was success defined specific to that program?

- What industry sectors would be or have been most successful in the creation and implementation of Employee Ownership models?

5. QUESTIONS AND ANSWERS (From Respondents to the NJEDA)

All questions concerning this RFI must be submitted in writing no later than 12pm EST, on Wednesday, April 10th via e-mail to: EmployeeOwnership@njeda.gov.

The subject line of the e-mail should state: “QUESTIONS-2024 RFI-199 Development of a Statewide Employee Ownership Program”.

Answers to questions submitted will be publicly posted on the Authority’s website on or about Wednesday, April 17th at: Bidding Opportunities – NJEDA as Addendum

IT IS THE RESPONDENT’S RESPONSIBILITY TO CHECK THIS URL REGULARLY FOR UPDATES.

6. RESPONSE DETAILS (Info Provided to Respondents Regarding Document Submission)

All RFI responses must be submitted in writing no later than 11:59pm EST, on Wednesday, April 24th via e-mail to: EmployeeOwnership@njeda.gov

The subject line of the e-mail should state: “RFI Response-2024-RFI-199 Development of a Statewide Employee Ownership Program”.

7. FOLLOW-UP QUESTIONS (from the NJEDA) / ADDITIONAL INFORMATION

Respondents may be asked to provide additional information to allow the Authority to better understand the responses or services available.

8. PROPRIETARY AND/OR CONFIDENTIAL INFORMATION

The Authority reserves the right to copy any information provided by the Respondents. The Authority reserves the right to use ideas that are provided by Respondents, applicants, stakeholders, or vendors. By submitting a Response, the submitter represents that such copying or use of information will not violate any copyrights, licenses, or other agreements with respect to information submitted or product solutions demonstrated, if applicable. Responses must clearly be marked for any information the Respondent deems Proprietary and/or Confidential.

9. DISCLAIMER / NO OBLIGATION

This RFI is not a request for qualification/proposal. It may or may not result in further action.

This RFI is issued solely as a means of gathering information regarding the Authority’s desire to understand the types of products and level of service available in the market to meet the Authority’s needs. Interested parties responding to this RFI do so at their own expense. There will be no monetary compensation from the Authority for the time and effort spent in preparing the response to this RFI. All expenses incurred are the sole responsibility of the Respondent.

Should the Authority decide to move forward and issue an RFQ/P or announce a program/product related to this RFI, Respondents need not have submitted a response to this RFI in order to be eligible to respond to the RFP. Should an RFQ/P be issued, responding to this RFI will not affect scoring or consideration for that process.

The Authority is under no obligation to contact Respondents to this RFI.

10. NEW JERSEY OPEN PUBLIC RECORDS ACT

Respondents should be aware that responses to this RFI are subject to the “New Jersey Open Public Records Act” (N.J.S.A. 47:1A-1 et seq.), as amended and including all applicable regulations and policies and applicable case law, including the New Jersey Right-to-Know law. All information submitted in response to the RFI is considered public information, notwithstanding any disclaimers to the contrary, except as may be exempted from public disclosure by OPRA and the common law. Any proprietary and/or confidential information submitted in response to this RFI will be redacted by the Authority. A person or entity submitting a response to this RFI may designate specific information as not subject to disclosure pursuant to the exceptions to OPRA found at N.J.S.A. 47:1A-1.1, when such person or entity has a good faith legal and/or factual basis for such assertion (i.e. information that may be included in another ongoing public procurement or solicitation). The Authority reserves the right to make the determination as to what is proprietary or confidential and will advise the person or entity accordingly. The Authority will not honor any attempt to designate the entirety of a submission as proprietary, confidential and/or to claim copyright protection for the entire proposal. In the event of any challenge to the Respondent’s assertion of confidentiality with which the Authority does not concur, the Respondent shall be solely responsible for defending its designation.

New Jersey Economic Development Authority

REQUEST FOR INFORMATION

2024-RFI-207 for Artificial Intelligence Hub

1. INTENT/SUMMARY OF SCOPE

The New Jersey Economic Development Authority (“Authority”), an independent Authority of the State of New Jersey, is seeking information and ideas from qualified entities (“Respondents”) in the creation of a transformational artificial intelligence innovation hub (“AI hub”) to promote and integrate various applications of artificial intelligence (“AI”).

This Request for Information (RFI) is issued by the New Jersey Economic Development Authority (“Authority”, “NJEDA”) and Princeton university (“Princeton”) this RFI seeks to collect input around best practices and operational insights surrounding the AI hub, and further seeks to garner specific interest for engagement in the AI hub by respondents. The NJEDA and Princeton are interested in receiving comments, questions, recommendations, facts, information, ideas, and responses that will help the parties better understand the scope and characteristics of the Artificial Intelligence Hub in response to Executive Order 346 and the overall AI opportunity.

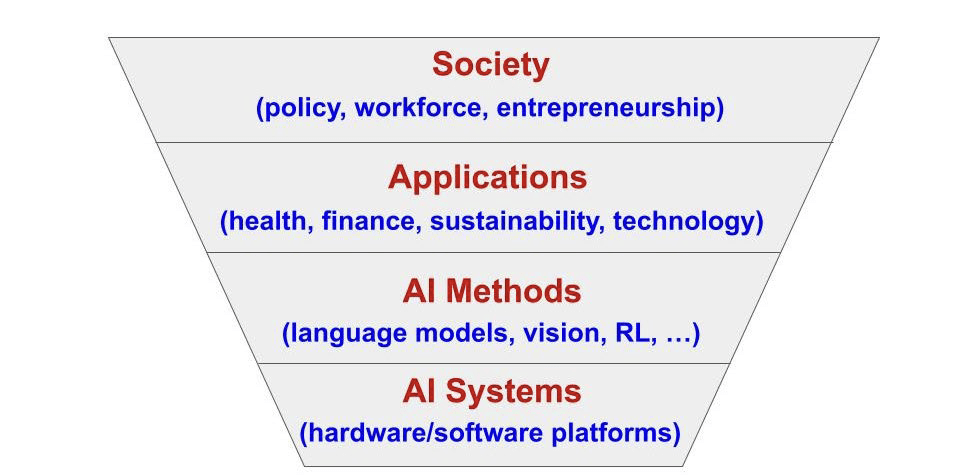

Artificial intelligence (“AI”) is transforming nearly every industry sector, academic discipline, and human endeavor, through powerful techniques for turning massive amounts of raw data into new knowledge, deeper insights, and better decisions. New Jersey has the potential to become the east coast hub for AI innovation given its assets in research and development, educational and training pipelines, and location. To enhance New Jersey’s status as a flagship for AI, NJ Governor Murphy and Princeton University President Christopher Eisgruber announced on December 18, 2023, that the State of New Jersey and Princeton University are collaborating to launch a transformational artificial intelligence innovation hub (“AI hub”). The AI hub will initially concentrate on four focal areas:

1.Society: Advance the study of and development of policy surrounding the ethical implementation of AI and its societal impacts (e.g., consumer/business protection, ethics, regulation, entrepreneurship, and workforce development).

2. Applications: Create infrastructure that allows industry and other stakeholders to apply AI, especially in the key economic sectors of pharma-med tech, finance, technology, clean energy, and advanced manufacturing.

3. AI Methods: Providing AI technical support through development of large language models, computer vision pipelines, as well as software applications via wide collaboration between industry and academia.

4. AI Systems: Support hardware and software design, innovation, computing architecture construction and underlying semiconductor innovation to support AI advances.

The AI hub seeks to:

• Establish central New Jersey as a leading national base for AI innovation

• Develop a vertically integrated institute spanning all levels of AI innovation

• Leverage close partnerships among academia, industry, and government

• Promote rapid and responsible development of the field

• Drive job growth and regional economic and workforce development

• Expand the central New Jersey innovation ecosystem, including by seeding the formation of new start-ups while providing the tools to enable existing industries and academic researchers to capitalize on the AI revolution

• Guide government and public entities on AI implementation

• Further Princeton University’s teaching and research mission, and enhance the educational experience of the University’s students

The State of New Jersey and Princeton University envision an integrated hub of AI activity that leverages Princeton’s and the region’s strengths, while also drawing on and amplifying other strengths in the central New Jersey region, including:

• industrial assets in the medical, financial, energy, and engineering sectors

• national labs, such as Princeton Plasma Physics Laboratory (PPPL) and the Geophysical Fluid Dynamics Laboratories (GFDL), that can leverage AI to enhance their research on sustainability (e.g., fusion energy and climate modeling)

• a strong system of regional colleges and universities, including two-year community colleges and vocational schools, that contribute to the local workforce

• a growing regional innovation ecosystem of start-up companies, established firms (e.g., Google DeepMind Princeton), and startup accelerators (e.g., Helix and HAX), as well as proximity to a wide range of NYC and Philadelphia-based companies and assets.

We anticipate that this AI hub will house AI researchers, start-up companies, and other collaborators in dedicated space. We are exploring the potential for various approaches to fully integrating stakeholders to ensure success. This AI hub will also leverage the University’s convening power to regularly bring together national and state leaders on AI to discuss all the top issues of the day.

To engage potential partners and build collaborative relationships in the AI hub, the NJ Economic Development Authority (the “NJEDA” or “Authority”) and Princeton University are issuing a Request for Information (“RFI”) for involvement in the AI hub. This RFI seeks to collect input around best practices and operational insights surrounding the AI hub, and further seeks to garner specific interest for engagement in the AI hub by respondents.

The NJEDA and Princeton University are interested in receiving input that will help identify potential partners and highlight how respondents could assist with catalyzing a hub for AI activity in New Jersey. The NJEDA and Princeton also seek responses that identify specific sites, financial contributions, and other resources (e.g., staffing, programmatic resources, computing resources, other in-kind supports, etc.) that the respondent may contribute to the development and operations of the AI hub.

2. BACKGROUND

The New Jersey Economic Development Authority serves as the State’s principal agency for driving economic growth. The Authority is committed to making New Jersey a national model for inclusive and sustainable economic development by focusing on key strategies to help build strong and dynamic communities, create good jobs for New Jersey residents and provide pathways to a stronger and fairer economy. Through partnerships with a diverse range of stakeholders, the Authority creates and implements initiatives to enhance the economic vitality and quality of life in the State and strengthen New Jersey’s long-term economic competitiveness.

The NJEDA serves as the State’s principal agency for driving economic growth. The Authority is committed to making New Jersey a national model for inclusive and sustainable economic development by focusing on key strategies to help build strong and dynamic communities, create good jobs for New Jersey residents, and provide pathways to a stronger and fairer economy. Through partnerships with a diverse range of stakeholders, the Authority creates and implements initiatives to enhance the economic vitality and quality of life in the State and strengthen New Jersey’s long-term economic competitiveness.

Governor Murphy’s economic development strategic plan, “The State of Innovation: Building a Stronger and Fairer Economy in New Jersey” specifically highlights investing in emerging innovative industries as critical to the State’s economic development strategy. New Jersey will take a proactive,

targeted approach to support innovative, resilient growth industries that provide living wages for New Jersey residents. A stronger and fairer New Jersey economy will prioritize innovation sectors that best support New Jersey’s long-term economic future. Recognizing the significant opportunity that exists around the development of AI, on October 10th, 2023, Governor Murphy authorized Executive Order 346, establishing the state’s Artificial Intelligence Task Force, “responsible for studying emerging artificial intelligence technologies in order to issue findings on the potential impacts of these technologies on society and offer recommendations to identify government actions.”

The subsequent Task Force has convened several professionals across the State of New Jersey, with groups focused on determining next steps regarding:

• Security, safety, technology, and privacy considerations

• Workforce training and jobs of the future for the public sector

• AI equity and literacy

• Making New Jersey a hub for AI innovation

Additionally, on November 20th, 2023, the Governor’s office unveiled a policy guide for use of generative AI by state employees. This policy emphasis was the first offering in what is slated to be extensive training available to state workers, aimed at enhancing equity and service to all New Jersians.

Throughout this process, the capacity and expertise of Princeton University as a transformational agent in relation to the burgeoning field of AI became apparent. Princeton University, has had a strong presence in computer science and innovation for years through its academic departments and research initiatives, dating back to Alan Turing, who many consider the father of computer science and who earned his Ph.D. at Princeton in 1938. Today, three main strengths come together to support AI innovation at the University:

• Foundational strengths – Princeton’s researchers push the limits of AI methods to make them faster, more accurate, and more explainable.

• Interdisciplinary strengths – Princeton’s researchers collaborate across disciplinary and departmental lines to apply AI to advance discovery in a wide range of disciplines all over campus.

• Service to society – faculty and researchers are addressing the societal challenges that AI can help us tackle and the new challenges that AI itself is introducing.

In addition to Princeton’s strong academic focus on computer science and machine learning, the University has launched a myriad of AI initiatives in areas such as large language models (Princeton Language and Intelligence), precision health (Princeton Precision Health), community outreach and workforce development (AI4ALL), policy (Center for Information Technology Policy; School of Public and International Affairs), and engineering (School of Engineering and Applied Science). Princeton faculty and researchers have also launched several AI-related start-ups.

Accordingly, the Princeton University Trustees found in the latest strategic framework that “[g]oing forward, Princeton can lead in creating and understanding large-scale AI models and applying them to the humanities, social sciences, natural sciences, and engineering. The University can also play a crucial role in creating scalable shared platforms for collecting and analyzing data about our

increasingly information-driven world.” As further stated in the University’s strategic framework, “it is important for research and education in AI to remain broadly and easily accessible in the public sphere so as to enable greater technological advances, applications across a range of academic disciplines, thoughtful consideration of societal implications, and the education of future leaders. Princeton has a unique capacity to meet this challenge.”

The announcement of the AI hub, coupled with the prior creation of the AI Taskforce, issuance of executive orders, appointment of Beth Noveck as New Jersey’s first-ever Chief AI Strategist, and Princeton University’s extensive focus on AI, highlight the incredible opportunity that exists around artificial intelligence in the state of New Jersey. Given the projected exponential growth in the AI space over the next decade and its immense capacity for business acceleration and innovation, the NJEDA intends to support these efforts through collaboration in the AI hub as well as potential incentives and policies to attract and support interested parties.

3. ELIGIBILITY CRITERIA (If applicable)

The RFI is seeking responses from all interested stakeholders. Specifically, this RFI welcomes input from organizations, coalitions, and individuals including:

• AI software developers

• AI Hardware service supporters

• Data analysis, data extrapolation firms with processes focused on AI utilization

• Entities interested in AI training and development

• Firms focused on consumer protection, privacy, and intellectual property

• Higher education academic institutions and AI researchers

• Technology workforce providers

• Private entities with documented AI utilization

• Private entities with AI utilization aspirations

• Technology workforce providers

• Workforce development and community outreach professionals

• Firms in medical, financial, life sciences, and engineering sectors

• Firms with urban planning and/or economic development expertise

Respondents do not need to be located within the State of New Jersey to provide a response.

4. RFI RESPONSE QUESTIONS

Please answer all questions that are relevant to you or your organization, to the best of your ability. Answers to these questions are understood to be preliminary and non-binding. Applicants are free to structure responses as necessary to increase clarity and efficiency of responses.

Please provide information on your name, title, organization, contact information, organization web address, and your capacity and qualifications within the artificial intelligence industry.

A. New Jersey as an AI leader

1. How can we position the state for leadership in AI? Please provide specific recommendations that will allow the state and region to take a differentiated leadership role.

2. What unique opportunities do you think New Jersey should consider as part of this AI Hub development relative to research, talent, and commercialization?

3. What assets can you contribute to driving NJ into an AI leader? Please be specific on how you would hope to develop these assets as a part of the AI hub.

4. Who are the 3-5 AI stakeholders (other than yourself/your organization) the State of New Jersey should be aware of? What type of innovations/programs are they working on? Why should the state be aware of them?

B. AI Hub support and engagement

1. How might the AI hub best advance the goals of your organization or larger sector?

2. What resources or enhancements would help amplify the impact of the AI hub (e.g., investment, research capacity, higher education, workforce/lifestyle supports)?

3. How would you envision your role in advancing AI innovation in New Jersey as part of the AI hub? Would you seek to provide sponsorship, tenancy, data, or other contributions to the AI hub?

4. Would you seek to participate as an angel investor or provide venture capital to hub-related businesses?

5. Would your organization seek to engage in other roles such as mentoring entrepreneurs and early-stage founders or providing supports to diverse business enterprises?

6. Given the location requirements, would you be interested in donating or subsidizing the cost of space to support the AI hub (e.g., co-working, conference, offices, events, labs, etc.)?

7. How would your organization or institution contribute to the educational or research efforts of the AI hub?

8. How would your organization’s involvement in the AI hub support or complement Princeton University’s mission of education, research, and service to humanity?

C. AI workforce supports

1. Regarding workforce development, would you seek to train/educate on AI related topics, teach specialized skills, develop new education/university programs, provide internships, and/or provide new or non-traditional apprenticeships?

2. How would you envision your organization playing another role in advancing education and inclusive workforce development for AI-related topics?

3. What suggestions do you have for building an AI workforce? What role should community colleges play?

4. Are there additional comments you wish to share that do not directly respond to one of the above questions?

5. QUESTIONS AND ANSWERS (From Respondents to the EDA and Princeton University)

All questions concerning this RFI must be submitted in writing no later than 11:59 PM EST, on Friday, April 19th via e-mail to: AIHub@njeda.gov.

The subject line of the e-mail should state: “QUESTIONS-2024 RFI-#207 AI Hub.”

IT IS THE RESPONDENT’S RESPONSIBILITY TO CHECK THIS URL REGULARLY FOR UPDATES.

6. RESPONSE DETAILS (Info Provided to Respondents Regarding Document Submission)

All RFI responses must be submitted in writing no later than 11:59 PM EST, on Friday May 31st via e-mail to: AIHub@njeda.gov.

The subject line of the e-mail should state: “RFI response – AI Hub.”

7. FOLLOW-UP QUESTIONS (from the NJEDA) / ADDITIONAL INFORMATION

Respondents may be asked to provide additional information to allow the Authority and Princeton to better understand the responses or services available.

8. PROPRIETARY AND/OR CONFIDENTIAL INFORMATION

The Authority and Princeton University reserve the right to copy any information provided by the Respondents. The Authority and Princeton University reserve the right to use ideas that are provided by Respondents, applicants, stakeholders, or vendors. By submitting a Response, the submitter represents that such copying or use of information will not violate any copyrights, licenses, or other agreements with respect to information submitted or product solutions demonstrated, if applicable. Responses must clearly be marked for any information the Respondent deems Proprietary and/or Confidential.

9. DISCLAIMER / NO OBLIGATION

This RFI is not a request for qualification/proposal. It may or may not result in further action. This RFI is issued solely as a means of gathering information regarding Princeton and the Authority’s desire to understand the types of products and level of service available in the market to meet the Authority’s needs. Interested parties responding to this RFI do so at their own expense. There will be no monetary compensation from the issuers for the time and effort spent in preparing the response to this RFI. All expenses incurred are the sole responsibility of the Respondent.

Should the issuers decide to move forward and issue an RFQ/P or announce a program/product related to this RFI, Respondents need not have submitted a response to this RFI to be eligible to respond to the RFQ/P. Should an RFQ/P be issued, responding to this RFI will not affect scoring or consideration for that process.

The issuers are under no obligation to contact Respondents to this RFI.

10. NEW JERSEY OPEN PUBLIC RECORDS ACT

Respondents should be aware that responses to this RFI are subject to the “New Jersey Open Public Records Act” (N.J.S.A. 47:1A-1 et seq.), as amended and including all applicable regulations and policies and applicable case law, including the New Jersey Right-to-Know law. All information submitted in response to the RFI is considered public information, notwithstanding any disclaimers to the contrary, except as may be exempted from public disclosure by OPRA and the common law.

Any proprietary and/or confidential information submitted in response to this RFI will be redacted by the Authority. A person or entity submitting a response to this RFI may designate specific information as not subject to disclosure pursuant to the exceptions to OPRA found at N.J.S.A. 47:1A-1.1, when such person or entity has a good faith legal and/or factual basis for such assertion (i.e. information that may be included in another ongoing public procurement or solicitation). The Authority reserves the right to make the determination as to what is proprietary or confidential and will advise the person or entity accordingly. The Authority will not honor any attempt to designate the entirety of a submission as proprietary, confidential and/or to claim copyright protection for the entire proposal. In the event of any challenge to the Respondent’s assertion of confidentiality with which the Authority does not concur, the Respondent shall be solely responsible for defending its designation.

REQUEST FOR EXPRESSIONS OF INTEREST (RFEI)

REQUEST FOR EXPRESSIONS OF INTEREST (“RFEI”)

New Jersey Green Fund

The deadline for the NJ Green Fund RFEI has been extended indefinitely, until a formal application has launched.

1.0 Purpose and Intent

To meet New Jersey’s ambitious clean energy goals, the New Jersey Economic Development Authority (“NJEDA”) is issuing a Request for Expressions of Interest (“RFEI”) from project developers, owners, financial institutions, and other relevant parties seeking capital from the NJEDA through the New Jersey Green Fund (“NJGF”), a planned initiative that will be housed within the NJEDA to invest in clean energy projects in the State. Currently contemplated NJGF products include warehousing and aggregation credit facilities; credit enhancements; pre-development and construction financing; and term loans and investments, amongst other structures. The purpose of this RFEI is to help inform the NJGF on desired financial structures and investment products best suited to the needs of the marketplace and help accelerate progress toward the State’s clean energy goals. Additionally, through the responses to the RFEI, the NJEDA can best determine the scale of financing needs across various NJGF products and market sectors. Please note, providing a response to this RFEI is not a formal application for funding nor a binding intent to pursue investment opportunities that may be made available through the NJGF in the future.

NJEDA is seeking expressions of interest from Respondents that identify specific sites, projects, or assets (“project”) within New Jersey that are interested in financial support from the planned NJGF. To be eligible for the anticipated NJGF financial support, assets/projects must be seeking at least $5 million in capital and must be new projects rather than ones seeking refinancing. In particular, NJEDA is looking to support projects in New Jersey that have financial needs that cannot be fully met by existing financial tools available on the private market.

2.0 Background

NJEDA works to expand the State’s economy and increase equitable access to opportunity by supporting high-quality job creation, catalyzing investment, and fostering vibrant, inclusive community development. In order to meet the State’s joint objectives of building a stronger and fairer economy while simultaneously accelerating the transition to a clean energy future, the NJEDA formed a designated Clean Energy department. NJEDA’s Clean Energy department is focused on advancing the growth of clean energy technologies and organizations in the State through various products that support NJEDA’s mission. Currently, NJEDA’s Clean Energy department actively manages several existing programs that finance clean energy investments, including the New Jersey Clean Energy Loans program (NJ CELs), the Offshore Wind Tax Credit program, the New Jersey Zero-Emission Vehicle Incentive Program (NJ ZIP), and the soon-to-be-launched Commercial Property Assessed Clean Energy (C-PACE) program.

Building on NJEDA’s experience of supporting the growth of clean energy technologies, Governor Murphy and the State legislature allocated seed capital in the FYE ’24 State budget to the New Jersey Green Fund, which is currently being organized within the NJEDA to invest in clean energy projects in the State. Planned NJGF investments, which may include equity investments, credit enhancements, loans, and other vehicles, will be aimed to facilitate an equitable clean energy transition in New Jersey by attracting private capital to enable the State to reach 100% clean energy by 2035 while also providing measurable benefits to Overburdened Communities, as designated by the New Jersey Environmental Justice Law (N.J.S.A. 13:1D-157).[1] For more information on New Jersey’s Overburdened Communities, including a list of these communities and an associated map, please visit: https://dep.nj.gov/ej/communities/. NJGF will accelerate clean energy deployment in New Jersey by collaborating with public and private investors, foundations, and other non-profit organizations to transform financing markets that will have positive and long-lasting environmental, economic, and social benefits. This work in New Jersey is able to leverage the growing track record and experience of state-level green banks across the United States that have, to date, deployed over $4.2 billion to mobilize more than $10.6 billion in private co-investment, including a strong focus on clean energy in low-income communities.[2] The NJGF represents a transformative opportunity for New Jersey through its introduction of a self-sustaining financial model that would augment the State’s current annual spending and anticipated federal funding to promote and advance energy efficiency, renewable energy, energy storage, and clean transportation.

[2] American Green Bank Consortium Annual Industry Report

The planned NJGF will offer financial products and support to stimulate larger private capital investments for, and deployment at scale of, clean energy technologies within New Jersey. Its market-responsive approach to structuring investments will allow the NJGF to be able to design products that address commercial gaps and barriers to clean energy advancement in the state.

Beyond its State allocation, NJEDA is actively pursuing other funding opportunities made available at the federal level, including the Greenhouse Gas Reduction Fund’s National Clean Investment Fund competition, to bolster the planned NJGF’s capital base. Additionally, NJEDA is working with the Department of Energy Loan Programs Office and was recently qualified as a State Energy Financing Institution (SEFI) that can unlock low-cost capital available through the federal Title 17 financing program

3.0 NJGF Priority Investment Categories

The planned NJGF through its investments will focus on creating and supporting clean energy opportunities by expanding financing markets, mitigating risk to attract private investment, and increasing availability of capital where it is limited. Minimum project requirements for NJGF investment are outlined in Section 4.0. In particular, NJGF is seeking information on projects that either would likely not occur given the current state of the private markets or might occur in the private markets but would likely (i) involve less favorable tenor, cost, fees, and/or other key transaction terms; (ii) not happen at the market breadth needed to scale the sector; (iii) not have the same level of focus on reaching New Jersey residents in Overburdened Communities; and/or (iv) not happen as expeditiously. Consequently, the NJGF will accelerate an equitable transition to a clean energy economy in the State. That focus will be centered thematically on three key market areas:

3.1 Building Decarbonization and Resiliency

New Jersey has aggressive goals to reduce greenhouse gas emissions from its building sector, which is the second highest source of emissions in the State.[1] These include:

- 100% clean energy by 2035 (Murphy Executive Order 315)[2]

- Zero-emission heating/cooling systems in 400,000 dwelling units by 2030 (Murphy Executive Order 316)[3]

- Zero-emission heating/cooling systems in 20,000 commercial/public spaces by 2030 (Murphy Executive Order 316)[4]

Given New Jersey’s coastal location in the northeast, enhancing resiliency within the built environment is also critical to managing climate change. Since 1980, the State of New Jersey has been affected by 62 extreme weather events that each have had nationwide cumulative losses exceeding $1 billion.[5] Climate change is expected to continue to threaten New Jersey (and the nation) with increased temperatures, rising sea levels, and more intense rainfall events.[6] These challenges pose risk to buildings in the State that, through its own operating emissions, can continue to exacerbate these threats without increased decarbonization and resiliency efforts.

[2] Murphy Executive Order #315

[3] Murphy Executive Order #316

[4] Murphy Executive Order #316

[5] National Oceanic and Atmospheric Administration (“NOAA”) National Centers for Environmental Information (“NCEI”)

By providing access to affordable capital, the planned New Jersey Green Fund can empower additional greenhouse gas emissions reductions from the existing and proposed buildings in the State. The State continues to make measured progress towards the goal of reducing overall emissions by 80 percent by 2050 (Global Warming Response Act of 2007)[1], as well as an interim goal of a 50 percent reduction by 2030 (Murphy Executive Order 274)[2]. With an extensive statewide existing building stock and as the nation’s most densely populated state, New Jersey’s capital requirements will continue to be a significant barrier to building sector emissions reductions.[3] In particular, building decarbonization projects for existing buildings typically have longer payback periods and can be more capital intensive than conventional energy efficiency improvements. These challenges are even more burdensome for buildings located in Overburdened Communities that historically have seen less access to capital and often face a backlog of regular building maintenance activities.

[1] Global Warming Response Act

[2] Murphy Executive Order #274

3.2 Zero-Emission Transportation

The transportation sector is the largest contributor to greenhouse gas emissions in the State.[1] In addition to targeting 100% clean energy by 2035 (Murphy Executive Order #315)[2], New Jersey’s aggressive goals for greenhouse gas emissions reductions also include having 330,000 light duty zero-emission vehicles on the road by 2025, with 2 million registered by 2035 (EV Act of 2019)[3].

[2] Murphy Executive Order #315

In conjunction with electrification of fleets from polluting combustion vehicles, associated charging stations are required throughout the State to enable convenient and efficient vehicle charging. Zero-emission transportation does not just reduce emissions from the transportation sector. When coupled with managed charging programs or vehicle to grid power connections, zero-emission vehicles can function as battery storage systems and grid assets.

Ongoing zero-emission vehicle grant and incentive programs available through the NJEDA, the New Jersey Department of Environmental Protection (“NJDEP”), the New Jersey Board of Public Utilities (“NJBPU”), and private utilities have helped encourage increased adoption of electric vehicles in New Jersey. However, these programs do not cover the full acquisition costs of vehicles or fully address the scale of transition needed within the timeline of the State’s goals, leaving a funding gap that can be met by financing. In particular, for medium and heavy-duty vehicles, the high costs of vehicles pose challenges to commercial entities looking to transition their fleets to cleaner alternatives. Additionally, conventional financing institutions are often hesitant to finance innovative technologies, such as alternative zero-emission vehicles, that are newer to the marketplace

By providing access to affordable capital, the planned NJGF will accelerate the adoption of zero-emission transportation in the New Jersey market and reduce emissions from the highly polluting transportation sector.

[1] NJDEP

[1] Global Warming Response Act

[1] Murphy Executive Order #274

[1] NJDEP

[1] Murphy Executive Order #315 [1] EV Act of 2019

3.3 Clean Energy Generation and Storage

Increased access to clean distributed power generation with renewable energy systems will strengthen the local and national power system, improve energy security, and help ensure that every community benefits from the clean energy transition.

New Jersey State goals for clean energy production and storage include:

- 100% clean energy by 2035 (Murphy Executive Order #315)[1]

- 2 GW of energy storage available by 2030 (Renewable Energy Bill, A3723)[2]

- 11 GW of offshore wind capacity completed by 2040 (Murphy Executive Order #307)[3]

New Jersey has made progress towards these targets with 1.5 GW of offshore wind projects actively under development[4] and 4.56 GW of solar capacity installed in the State as of September 30, 2023.[5] However, even with these notable achievements, renewable energy only makes up 8.30% of the overall electric power generation in New Jersey as of 2022.[6]

By providing access to affordable capital, the planned NJGF can empower the development of additional renewable energy capacity and storage and allow the State to meet its clean energy goals. Low-cost financing will be critical for continued renewable energy investment. New Jersey is also particularly focused on developing community solar in the State. Recently, NJBPU raised the annual cap for its community solar program on allowed community solar subscriptions from 150 MW to 225 MW.[7] NJEDA is interested in investing in community solar projects, especially those that benefit Overburdened Communities and are housed on contaminated brownfield sites around the State.

[1] Murphy Executive Order #315

[2] Renewable Energy Bill, A3723

[3] Murphy Executive Order #307

[5] New Jersey’s Clean Energy Program

4.0 Minimum Project Requirements

Focusing on these three priority investment categories, the NJEDA is seeking project information to help design investment products best suited to accelerate progress toward the State’s clean energy goals and better understand the scale of financing need across various NJGF products and market sectors. Notwithstanding, we would seek interests for other types of projects as well. Projects supported by the planned New Jersey Green Fund will be subject to the following limitations:

- Assets/projects must be seeking at least $5 million in capital from the NJGF

- Assets/projects must have an equity contribution of at least 20%, excluding tax equity financing

- Assets/projects supported by NJGF must be primarily located in the State of New Jersey

- Assets/projects must be new rather than seeking refinancing

- Assets/projects must lead to reduced greenhouse gas emissions and/or criteria pollutants in the State; or similarly support New Jersey’s current clean energy and environmental goals

- The NJGF cannot provide support directly to individual consumers

5.0 RFEI Submission

5.1 Potential Respondents

The planned NJGF is interested in supporting a wide range of entities undertaking clean energy projects. These include conventional organizations such as major renewable energy developers or large real estate developers, but also smaller entities that may be more community focused. NJEDA encourages all interested parties to provide feedback to the RFEI. Potential Respondents to the RFEI may include but are not limited to:

- Property owners

- Real estate developers

- Renewable energy developers and operators

- Financial institutions

- Corporations

- Non-profit organizations

- Venture and private equity groups

- Community-based organizations, including those representing Environmental Justice Communities

- Other private entities

Please note, Respondents can submit multiple proposals to the RFEI, or include reference to multiple projects in one comprehensive proposal.

5.2 Timeline

| Date | Event |

| November 29, 2023 | Distribution of RFEI |

| December 15, 2023 | Deadline for Respondents to submit any questions on the RFEI content or process |

| January 12, 2024 | Deadline for Respondents to provide responses to the RFEI |

5.3 Required Information for Submission

| Category | Page Limit | Description |

| Cover Page | 1-page maximum | a. Lead entity’s name b. Primary point of contact information for lead Respondent (including: name, title, address, phone number, email address) c. Similar information for any Co-Respondents/partners |

| Entity Profile | 2-pages maximum | a. Summary of Respondent’s organizational history and background b. Organizational involvement with and/or commitments to clean energy, including a summary of relevant ongoing or recently completed projects c. Organizational size and/or operating capacity |

| Project Information | 5-pages maximum | a. Describe the project/asset seeking NJGF support. Include location, project type, specific technologies utilized, overall business model, expected sources of project revenue, and other relevant details to inform the project scope (size, renewable capacity, etc.). b. Explain how the project falls under any of the planned NJGF’s three priority investment categories (building decarbonization and resiliency, zero-emission transportation, or clean energy generation and storage), if applicable. c. Detail any potential benefits to the State, especially in regard to the State’s Overburdened Communities. These benefits should include positive environmental (i.e., projected emissions reductions, local air quality improvements) and economic (i.e., job creation) impacts directly or indirectly resulting from the project. |

| Capital Requirements and NJGF Investment Support | 5-pages maximum | a. Detail capital requirements expected for each project or total capital needs if Respondent is submitting regarding a portfolio of projects. Include an anticipated schedule for the project, detailing when capital will be needed during various stages of project development. b. Include an explanation for why the Respondent is seeking NJGF support in lieu of or in addition to existing financial tools available on the private market. This explanation may include barriers such as project credit constraints, high cost of capital, long project payback periods, technological risks, complex underwriting requirements, innovative business models, small transaction sizes, etc. c. Indicate what type of investment support you are seeking (e.g., loan, credit enhancement, equity investment, etc.) and when during project development the support would be needed (predevelopment, construction, acquisition, commercial operation date/term loan, etc.). c. Explain how the project/asset is expected to contribute to financial market transformation in terms of e.g., (i) reaching New Jersey residents in Overburdened Communities and/or with credit profiles that are typically deemed to be high risk (e.g., FICO scores below 650); (ii) creating scale; (iii) improving private sector participation; (iv) increasing level of awareness and confidence in the relevant sub-sector or business model; and/or (v) other aspects of market transformation. d. Outline any current or expected internal/external sources of funding (if known) to address financial needs beyond what financial support is being sought via the planned NJGF. |

5.4 Submission Process

All RFEI responses must be submitted no later than 5:00 PM ET on January 12, 2024, via email to: NJGFrfei@njeda.gov. The subject line of the email should state: NJGF RFEI Response – [Primary Applicant Name].

Any questions by prospective Respondents concerning this RFEI shall be sent by email to: NJGFrfei@njeda.gov, no later than 5:00 PM ET on December 15, 2023.The subject line of the e-mail should state: NJGF RFEI Questions.

6.0 Post-Submission Process

NJEDA may invite Respondents to provide additional information to allow NJEDA to better understand the information provided in the submittal.NJEDA may also request meetings with some or all of the Respondents to discuss details of responses.

Based on the feedback provided via the RFEI, NJEDA anticipates designing products within the planned NJGF. Future opportunities will be made available for Respondents and other members of the public to apply for NJGF funding regardless of whether they respond to the RFEI. The exact nature of these products will depend on product design, relevant project scope, and relevant source of NJGF funding.

7.0 New Jersey Open Public Records

Respondents should be aware that responses to this RFEI are subject to the “New Jersey Open Public Records Act” (N.J.S.A. 47:1A-1 et seq.), as amended and including all applicable regulations and policies and applicable case law, including the New Jersey Right-to-Know law. All information submitted in response to the RFEI is considered public information, notwithstanding any disclaimers to the contrary, except as may be exempted from public disclosure by OPRA and the common law.

Any proprietary and/or confidential information submitted in response to this RFEI will be redacted by the NJEDA. A person or entity submitting a response to this RFEI may designate specific information as not subject to disclosure pursuant to the exceptions to OPRA found at N.J.S.A. 47:1A-1.1, when such person or entity has a good faith legal and/or factual basis for such assertion (i.e., information that may be included in another ongoing public procurement or solicitation). The NJEDA reserves the right to make the determination as to what is proprietary or confidential and will advise the person or entity accordingly. The NJEDA will not honor any attempt to designate the entirety of a submission as proprietary, confidential, and/or to claim copyright protection for the entire proposal. In the event of any challenge to the Respondent’s assertion of confidentiality with which the NJEDA does not concur, the Respondent shall be solely responsible for defending its designation.

Fort Monmouth Economic REvitalization Authority (FMERA)

Bidding Opportunities

NOTICE TO INTERESTED BIDDERS

The Fort Monmouth Economic Revitalization Authority (FMERA) was created to provide investment, continuity and economic growth to the communities impacted by the federal government’s decision to close Fort Monmouth. FMERA has replaced the Fort Monmouth Economic Revitalization Planning Authority implementing the Reuse and Redevelopment Plan for economic development, growth and planning, with a focus on technology-based industries, for the 1,126 acres of real estate at Fort Monmouth following the base closure in September, 2011. The Fort Monmouth Reuse and Redevelopment Plan forwarded by the dissolved planning authority is a highly collaborative blueprint for action to:

- Promote, develop, encourage and maintain employment, commerce, economic development, and the public welfare

- Conserve natural resources

- Advance the general prosperity and economic welfare of the people in the affected communities and throughout the state

FMERA is given a multitude of tools to revitalize and redevelop the Fort Monmouth area and implement the revitalization plan. Among these are the abilities to undertake redevelopment projects, adopt development and design guidelines and land use regulations in connection with the provision of utilities, streets, roads or other infrastructure required for the implementation of the revitalization plan.

For additional bidding opportunities exclusive to FMERA; please access the FMERA website at www.fortmonmouthnj.com

Forms, Registrations & Certifications

Thank you for your interest in bidding opportunities with the NJEDA (Authority).

The Authority currently partners with the State of New Jersey and uses their vendor eProcurement Portal Database (NJSTART) to help identify potential vendors.