Economist’s Corner: The Importance of “Small Business” on the New Jersey Economy

Under Governor Murphy’s leadership and his plan for a stronger and fairer New Jersey economy, there has been an increased emphasis on the importance of small businesses and new business creation within the Garden State. Last year, the NJEDA realigned its operations to create a new small business-dedicated team, and has since introduced a variety of new small business programs.

Defining small business

Before we can begin to understand the impact of small business, we need to establish what constitutes a small business. The simple answer is, there is no one generally agreed to principle of what constitutes a small business. The US Small Business Administration uses a definition of an independent business with fewer than 500 employees. But this definition has a couple of inherent flaws. For one thing, this definition creates a net that snares a lot of relatively large businesses in terms of revenue and the scope of the customer base. Moreover, emphasis on number of employees misses an important point – more than 80 percent of all business entities in the US have no employees at all and likely never will.

For the sake of this brief, we’ll constrain our definition of small business to two groups of businesses:

2. Employer businesses with fewer than 20 employment jobs, where an employment job is a job offered by an employer to an employee through a contractual relationship.

Nonemployer businesses are often overlooked when discussing the impact of small business in New Jersey. In respect to the amount of GDP they create, overlooking them is understandable. In New Jersey, as in the rest of the US, they account for around just 3 percent of GDP. Moreover, since they don’t directly create employment, they generally receive little attention from economic policies focused on job growth. But these businesses are very important in several key ways. For one thing, there are a lot of nonemployer businesses. As of 2017, there were approximately 720,000 nonemployer businesses in New Jersey, which is around 80 percent of all businesses.

It also should be understood that nonemployer businesses essentially create jobs for their owners. So that’s 720,000 jobs. And although they do not directly create jobs for others, the economic activity they generate does create jobs through multiplier effects, generating economic activity throughout the economy via direct spending of the nonemployer’s income and indirect effects of the business’s expenditures on capital, rent, materials, and inputs from other businesses.

Although these businesses only account for 3 percent of economic activity, they are concentrated in some high value-added industries. For instance, the average nonemployer business earned $59,000, which is right in line with the average annual wage for all employer occupations . In New Jersey, the most nonemployer businesses are in some high value-added industries, including professional, scientific, and technical services (117,000), real estate (103,000), transportation and warehousing (81,000).

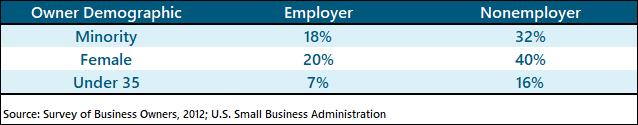

Also important about nonemployer businesses is their outsized impact on some economically underrepresented segments of the population. Relative to employer businesses, nonemployer businesses in the US are twice as likely to be female-owned and almost twice as likely to be minority-owned. Also, younger people are more than twice as likely to own a nonemployer firm. This means nonemployer businesses create economic opportunities for segments of the population that would otherwise likely be lacking.

Lastly, there is a lot of dynamism and growth in the nonemployer business ecosystem. From 2012 through 2017, the number of nonemployer business in New Jersey increased at a 3.3 percent annualized rate and nonemployer business receipts in New Jersey grew at a 3.9 percent annualized rate. These growth rates are both faster than underlying GDP growth in New Jersey, showing nonemployer businesses are a growing segment of New Jersey’s economy.

“Small” Employer businesses in New Jersey

There are approximately 160,000 small employer businesses in New Jersey, accounting for around 87 percent of all employer businesses. Although they are such a large share of businesses, they account for only around 19 percent of New Jersey jobs and 13 percent of payrolls. The reason is most of these small employer businesses are truly small, employing one-to-four employees with an average payroll of around $77,000. Yet, these numbers add up. In sum, approximately 665,000 employees work for small businesses, generating around $28 billion in payroll income per year.

As with nonemployer businesses, small employer businesses are more likely to be minority- or female-owned than larger businesses. Of small businesses, approximately 27 percent are minority owned and 31 percent are female owned. It’s also important to note the significance of small employer businesses varies depending on the industry. For instance, around half of total construction industry income in New Jersey is generated by small employer businesses. This share drops to less than 8 percent in finance and insurance. In construction, 16 percent of small employer businesses are female-owned and 12 percent are minority-owned. In retail, these shares jump to 40 percent minority-owned and 38 percent female-owned. The point being, the impact small businesses have on the economy varies significantly from industry to industry. Graphics depicting the impact of small businesses in New Jersey by industry are displayed at the end of this brief.

The Aggregate Small Business Landscape in New Jersey

Adding together data on small employer businesses and nonemployer businesses allows us to examine the impact of the entire small business universe on New Jersey’s economy. To do so, it is useful to relegate impact into buckets of influence. In the following graphic we’re looking at four main buckets:

Similar graphics with data on some of New Jersey’s major industries appears at the end of this brief.

But when it comes to job creation, it’s new businesses – not small businesses — that matter

It’s really the creation of new firms, rather than small firms, per se, that’s the lifeblood of an economy. New firms, led by entrepreneurs, are essential to what the famous economist Joseph Schumpeter coined “creative destruction” — the process through which economic growth occurs as new firms replace older, less productive firms. Whereas new firms create net new jobs, firms that have existed for one year or longer essentially shift a lot of employees between firms and create very few net new jobs.

This is not to say movement of jobs between firms, often referred to as labor market churn, is not important. Quite contrary, it is very important for income growth of people who leave jobs to take better opportunities elsewhere. But when it comes to actual job creation and productivity, it’s new firms that matter most.

Conclusion

In sum, small business is certainly a lifeblood of economic opportunity for certain segments of the population, especially when we consider these businesses create jobs for their owners. Given the important contributions these businesses make to the economic lives of many New Jerseyans, the state should certainly do what it can to enable the creation and ongoing health of these businesses by lowering barriers to entry, providing efficient licensing and regulation, and ensuring a stable legal and tax backdrop so these businesses understand the “rules of the game” and owners feel comfortable investing in and growing their businesses. Moreover, it is important current and prospective small business are well informed about the resources New Jersey provides, such as the Small Business Lease Assistance Program, CDFI Initiative, NJ Ignite, and the recently-expanded Angel Investor Tax Credit, to support small businesses and startup development and growth.

The Small Business Landscape, by Industry

Related Content

April 25, 2024

NJEDA to Open Applications for 2024 NOL Program

TRENTON, N.J. (April 25, 2024) – The New Jersey Economic Development Authority (NJEDA) is opening applications for the 2024 Technology Business Tax Certificate Transfer Program, commonly known as the Net Operating Loss (NOL) program, on Wednesday, May 1st.

April 24, 2024

NJEDA Awards First $2M under Angel Match Program to Support Early-Stage Technology Companies

TRENTON, N.J. (April 24, 2024) – The New Jersey Economic Development Authority (NJEDA) has closed its first four approvals under the Angel Match Program, awarding a total of $2 million to support early-stage technology companies.

April 15, 2024

NJEDA Establishes New Jersey Green Bank to Advance Climate Goals

TRENTON, N.J. (April 15, 2024) – Last week, the New Jersey Economic Development Authority (NJEDA) Board approved the creation of the New Jersey Green Bank (NJGB), which will make investments in the clean energy sector that will help advance the state’s efforts to make an equitable transition to 100 percent clean energy.

.jpg.aspx?width=750&height=420)