Economist’s Corner: Manufacturing Trends in New Jersey

This latest version of The Economist’s Corner focuses on trends in New Jersey’s manufacturing sector. The report shows manufacturing in recent years is gaining an increased share of New Jersey’s economy following years of contraction. Moreover, recent trends towards job reshoring provide further impetus behind New Jersey’s manufacturing sector continuing to increase share of New Jersey’s dynamic economy.

New Jersey’s Manufacturing Sector: Industrial Vigor, as Viewed Through Four Charts

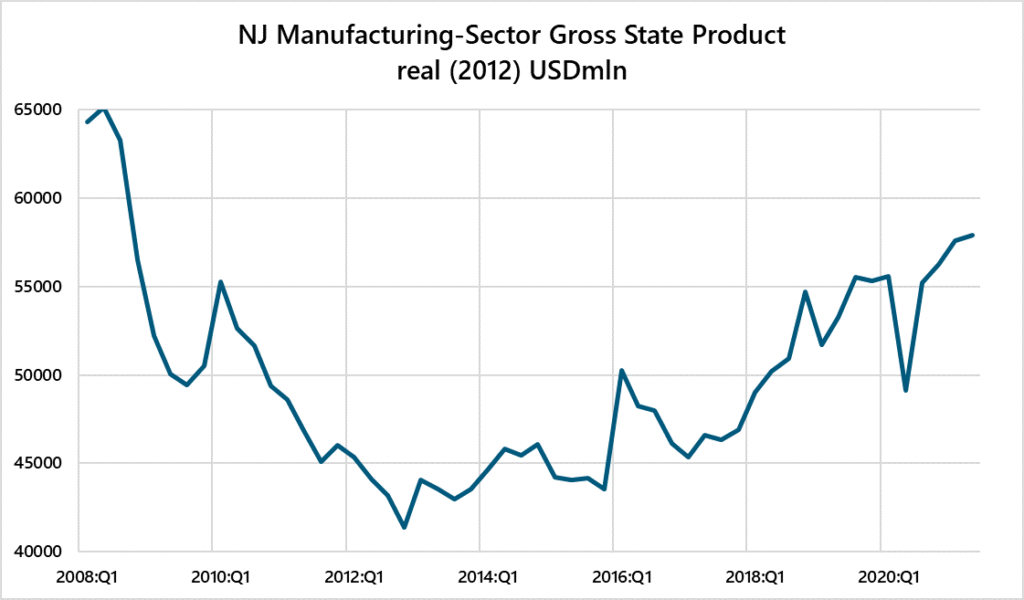

Manufacturing industry Gross State Product – Trending upward since 2018

Over the past four years, manufacturing has been one of New Jersey’s fastest expanding industries, growing at a 5.6 percent annualized pace. The strength has been concentrated in non-durable manufacturing – areas such as food and chemical products. This recent strength in manufacturing is quite a contrast to what the experience was in the aftermath of the 2008-09 recession, when manufacturing contracted at a 3.0% annualized rate through 2016.

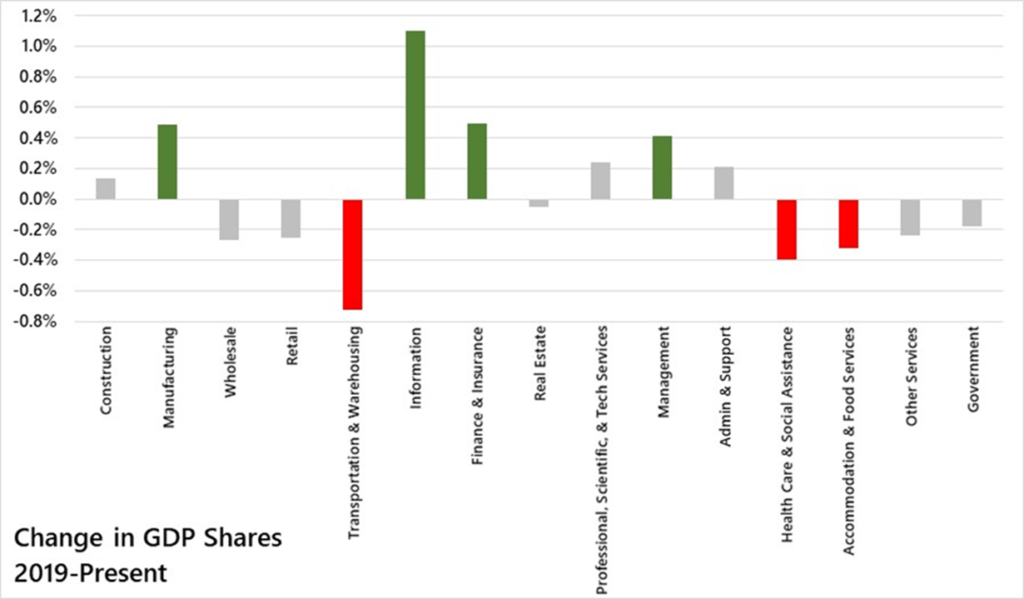

Manufacturing, along with some other high value-added industries,

is increasing as a share of New Jersey’s economy

Not only is manufacturing expanding at a solid clip, but it is becoming an increasing share of New Jersey’s overall economy. This chart looks at how shares of GDP have changed since the period right before the pandemic to today. As the chart shows, manufacturing as a share of the economy has increased by approximately 0.5 percentage points. Manufacturing currently accounts for around 11.3 percent of private-sector GDP.

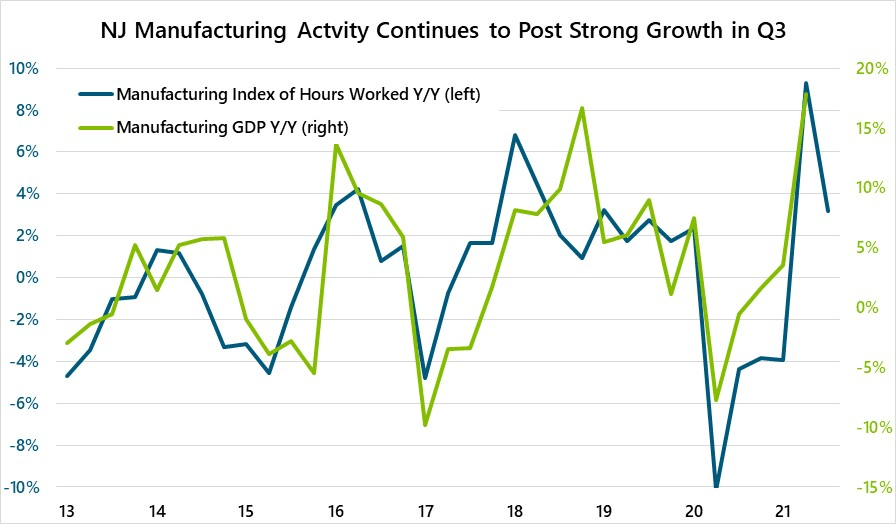

Labor market indicators and Federal Reserve surveys point to continued solid growth

Economists are always on the lookout for leading indicators that provide information on how economic activity is performing now and into the future. These next two charts do just that.

This is a chart of year-over-year changes in both the manufacturing index of hours worked and manufacturing GDP for New Jersey. The manufacturing index of hours worked is the product of the number of manufacturing employees and the hours they have worked. Essentially, it provides a measure of the amount of labor input in a given quarter. Given labor is a significant input in the manufacturing process, tracking labor output can tell us about manufacturing output. Here we see, through Q3, that manufacturing labor input continued to grow at very strong rate in line with manufacturing GDP near 10 percent year over year growth. Thus, manufacturing output continued to grow at a solid clip in Q3.

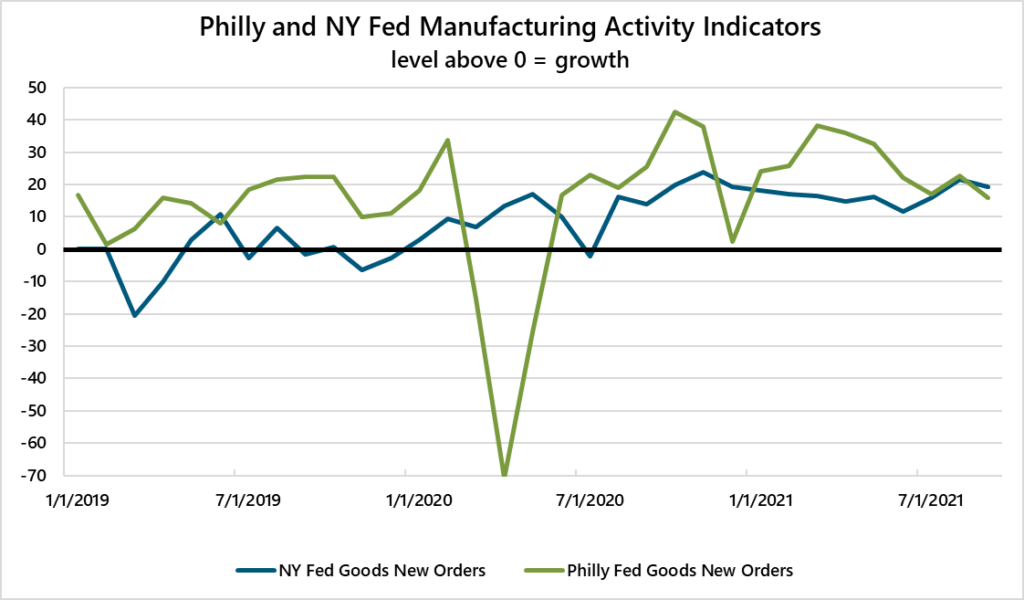

This chart shows data from two very useful surveys of manufacturing activity run by the Federal Reserve Banks of New York and Philadelphia. Here we are focused on indices for new orders, which is extremely helpful data for understanding near-term manufacturing activity because today’s orders become tomorrow’s production. Thus, when new orders are growing at a strong pace, it is a clear sign future production will, in turn, be strong.

In this context, anything above 0 indicates growth, so current levels near 20 signal double-digit growth. The one disclaimer is that it depends on whether demand is being filled by new production or previously produced inventories. However, given that inventories are stretched fairly thin currently, the ongoing growth of new orders signals a solid pace of manufacturing sector activity in Q4 and, likely, beyond.

A New Jersey Geography of Manufacturing Jobs, 2010-2019

This section provides an analysis of New Jersey residents who are manufacturing industry workers, as reported by the United States Census Bureau. The data presented here pertains to New Jersey residents and where they live, in contrast to where the manufacturing jobs or employers are located.

In the nine years just prior to the COVID-19 pandemic (2019 vs. 2010), New Jerseyans employed in manufacturing decreased from 396,000 (8.6 percent of the work force) in 2010 to 361,000 (7.7 percent of the work force) in 2019 — a 9.9 percent decrease in residents employed in manufacturing. However, there are some interesting trends throughout the state, including some places where the number of residents employed in manufacturing has increased. Moreover, as the analysis above shows, manufacturing in New Jersey in recent years is growing at a solid clip, which may reverse the shifts of the past nine years.

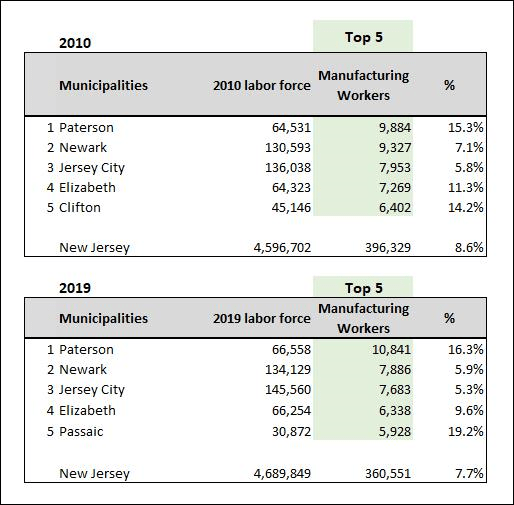

Top five municipalities in manufacturing worker residents in New Jersey,

by percentage of workforce, 2019 vs 2010

Looking at the raw numbers of residents in each municipality, the most populous cities unsurprisingly have the largest numbers of residents employed in manufacturing. The top five municipalities for manufacturing worker residents in 2010 included Paterson (9,884), Newark (9,327), Jersey City (7,953), Elizabeth (7,269), and Clifton (6,402). These rankings stayed mostly the same through 2019, except for the fifth spot, which switched from Clifton to neighboring Passaic. Clearly, the center of New Jersey manufacturing workers remains the northeast urban areas near New York City. The following map shows manufacturing worker density by municipality, both in levels and as a percent of labor force.

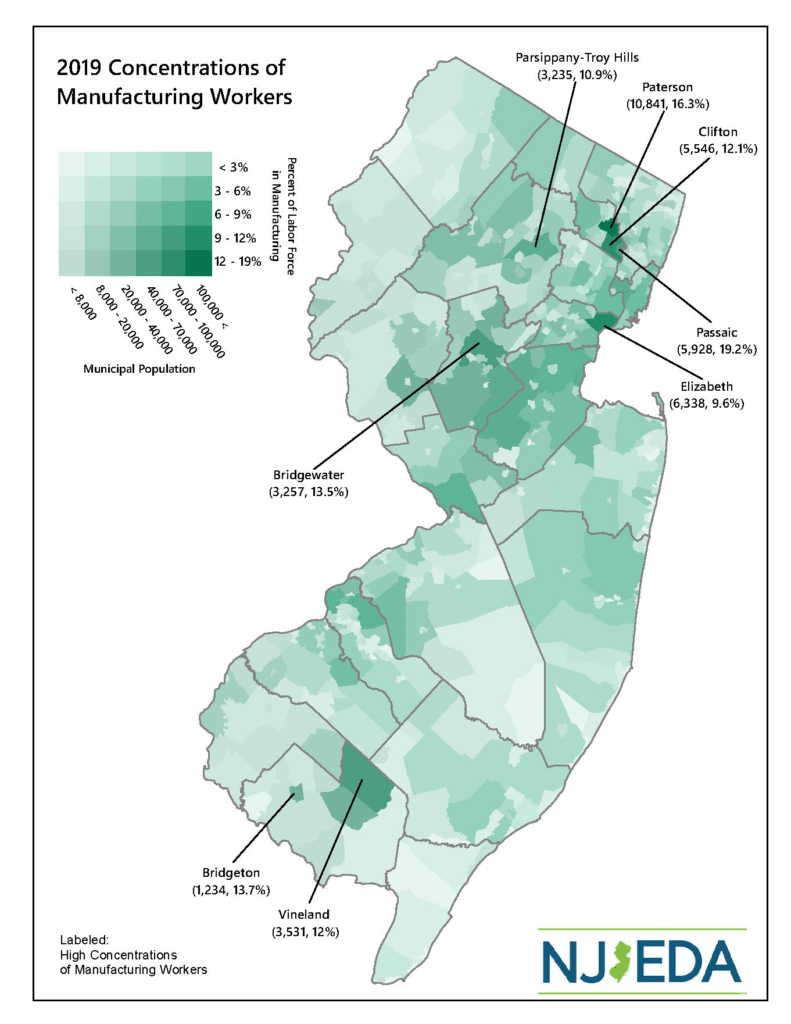

Map of manufacturing worker residents in New Jersey, levels and share of work force, 2019

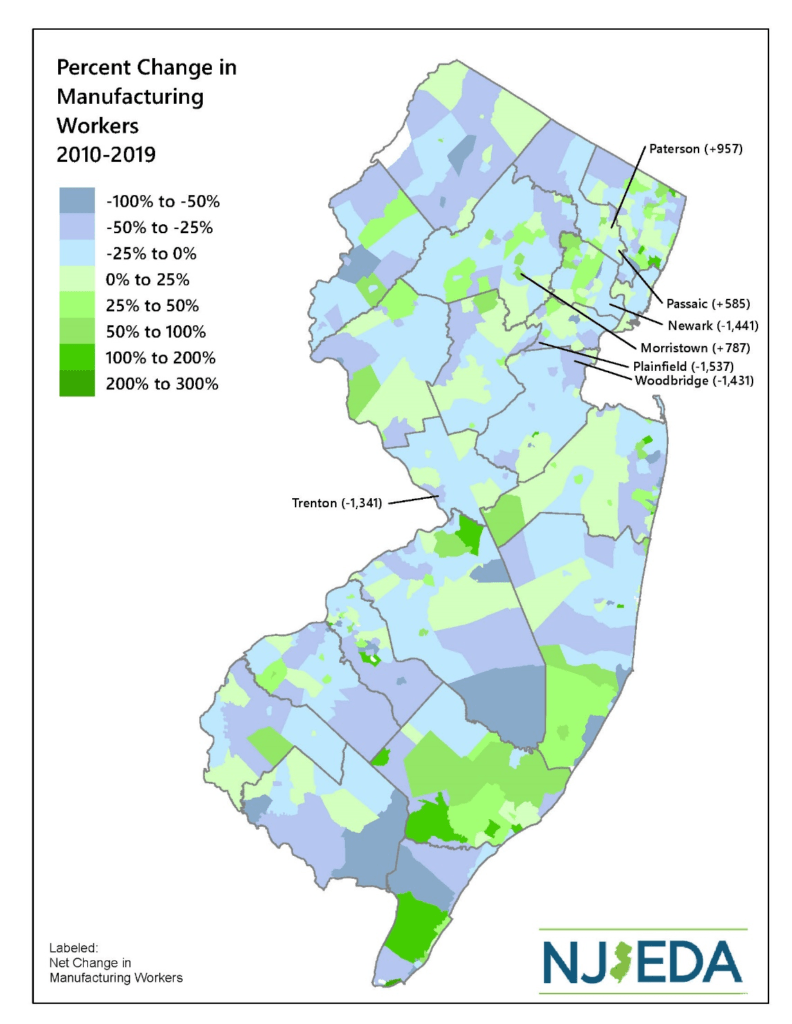

Looking at the following map related to changes across the state, rural areas generally saw decreases in manufacturing employees. Whether this is caused by changes in manufacturing locations, movement of residents, or a combination of factors would need further study support. However, there is evidence from the 2020 Census that indicates rural communities are losing population.

Map of percent change in manufacturing worker

residents in New Jersey, 2019 vs 2010

Outside of the northeastern manufacturing area, there is a notable increase in manufacturing employees in Atlantic County and Southern Ocean County. It will be of interest to follow how New Jersey’s new wind port, which is being built in Salem County, supports further manufacturing sector employment in and around the region.

The towns that saw the biggest decreases in residents employed in manufacturing from 2010-2019 share some similarities to those above. Plainfield (-1,537), Newark (-1,441), Woodbridge (-1,431), and Linden (-1,265) are also in this concentrated northeast urban area, while Trenton (-1,341), which has the fourth most manufacturing residents in the state, is not.

Reshoring Jobs: a Pre-COVID Trend Accelerated by the Pandemic

Among the many lessons the world has learned from the COVID-19 pandemic is the is the vulnerability of the global supply chain. Estimates suggest the pandemic affected 98 percent of global supply chains.[1] Companies that had previously prioritized a lean supply chain model that prioritized cost reduction and just-in-time production were not well prepared for major worldwide disruptions.[2]

As a result of the pandemic, some firms started to consider “reshoring” – the practice of bringing manufacturing and services back to the United States from overseas.[3] A May/June 2020 survey of 750 North American manufacturing firms found that 69 percent were either “likely” or “extremely likely” to reshore their overseas operations.[4] It is worth noting that the pandemic did not seem to cause the sudden interest in reshoring – rather, it accelerated an existing trend.[5] Evidence shows, over the past decade, China has lost the most reshored U.S. jobs (40 percent), followed by Mexico (23 percent) and Canada (10 percent). Over the past several years, the number of jobs cumulatively reshored to the United States has increased from about 100,000 in 2013 to over 500,000 in 2020.[6] In 2020, reshoring logged a record high 109,000 jobs announced.

The pandemic was the main driver of this recent surge, but analysts also view this landmark development as a combination of other factors, including greater U.S. competitiveness due to corporate tax and regulatory cuts, and rising concern over China’s competitiveness.[7] In general, a number of variables unrelated to the pandemic factor into a company’s decision to reshore. Rising wages in hosting countries are one of the most frequently cited reasons. Other reasons include protection of intellectual property, shorter supply chains, and the value of the “Made in USA” label as factors in decisions resulting in reshoring.[8] Despite the impact of COVID-19 and some promising developments in recent years, it’s important not to assume that reshoring is inevitable. Decisions on supply chains are made based on business fundamentals such as production costs and access to large markets. COVID-19 will likely not significantly affect those factors.

[1] https://www.supplychaindive.com/news/supply-chains-reshoring-decisions-sourcing-manufacturing-china/597596/

[2] https://www.brookings.edu/research/reshoring-advanced-manufacturing-supply-chains-to-generate-good-jobs/

[3] https://www.brookings.edu/research/reshoring-advanced-manufacturing-supply-chains-to-generate-good-jobs/

[4] https://www.areadevelopment.com/BusinessGlobalization/Q1-2021/job-creation-through-reshoring.shtml

[5] https://www.areadevelopment.com/BusinessGlobalization/Q1-2021/job-creation-through-reshoring.shtml

[6] Reshoring Initiative 2020 Data Report

[7] Ibid

[8] https://www.areadevelopment.com/BusinessGlobalization/Q1-2021/job-creation-through-reshoring.shtml; https://www.supplychaindive.com/news/supply-chains-reshoring-decisions-sourcing-manufacturing-china/597596/

Related Content

April 25, 2024

NJEDA to Open Applications for 2024 NOL Program

TRENTON, N.J. (April 25, 2024) – The New Jersey Economic Development Authority (NJEDA) is opening applications for the 2024 Technology Business Tax Certificate Transfer Program, commonly known as the Net Operating Loss (NOL) program, on Wednesday, May 1st.

April 24, 2024

NJEDA Awards First $2M under Angel Match Program to Support Early-Stage Technology Companies

TRENTON, N.J. (April 24, 2024) – The New Jersey Economic Development Authority (NJEDA) has closed its first four approvals under the Angel Match Program, awarding a total of $2 million to support early-stage technology companies.

April 15, 2024

NJEDA Establishes New Jersey Green Bank to Advance Climate Goals

TRENTON, N.J. (April 15, 2024) – Last week, the New Jersey Economic Development Authority (NJEDA) Board approved the creation of the New Jersey Green Bank (NJGB), which will make investments in the clean energy sector that will help advance the state’s efforts to make an equitable transition to 100 percent clean energy.